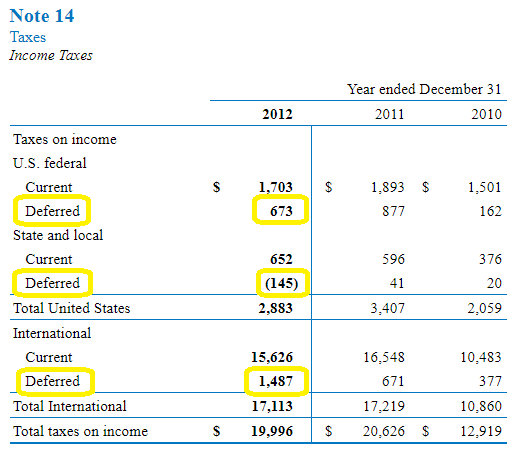

Cacique Accounting College - Today's topic - ACCA P2 - Corporate Reporting - Deferred Tax…😊 A Deferred Tax liability is an account on a company's Balance Sheet that is a result of

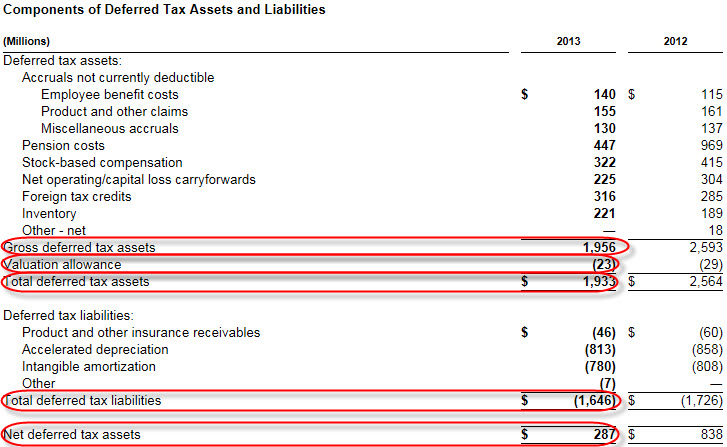

Reflex Research on Twitter: "1) At 2018 Tesla had $2.7bn gross deferred tax assets on balance sheet but had booked a $1.8bn valuation allowance against US losses to leave a net $0.9bn

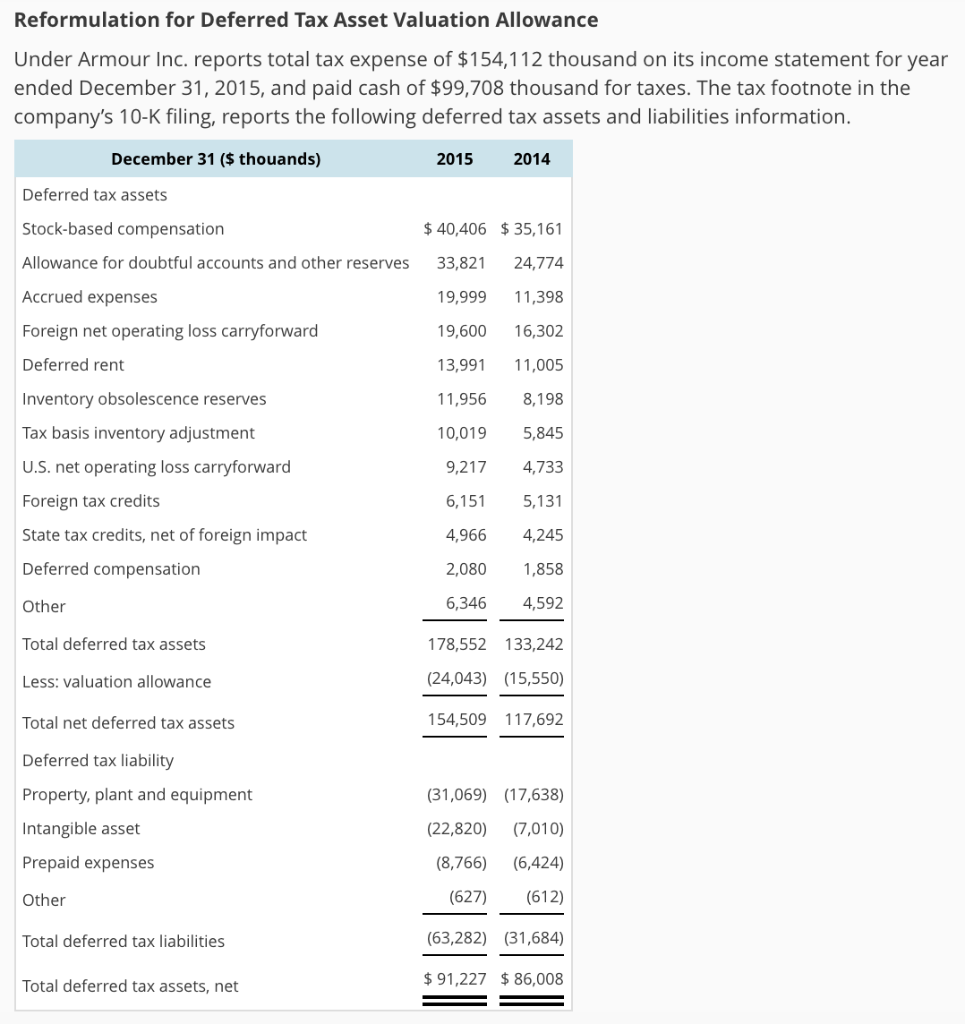

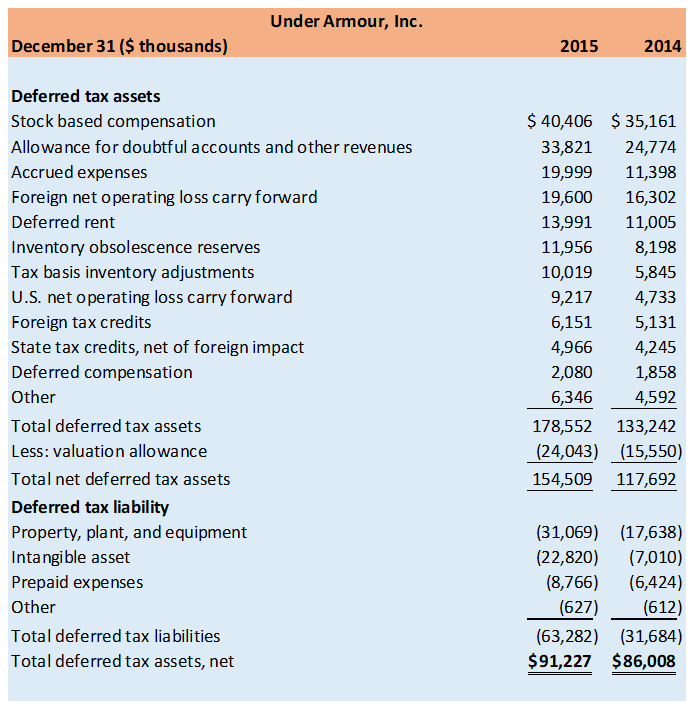

Training - Modular Financial Modeling II - Corporate Taxation - Detailed Modeling - Deferred Tax Liabilities | Modano

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)